Bond Valuation Question

Thanatos0320

Posts: 577 ✭✭✭

I know a few of you do accounting and finance work. I'm hoping you'll be able to help me with a question I came across while studying. My mind has gone completely blank. I messaged my professor 2 days ago and he still hasn't replied.

Bond X is noncallable and has 20 years to maturity, a 9% annual coupon, and a $1000 par value. Your required return on bond X is 10% and if you buy it you plan to hold it for 5 years. You (and the market) have expectations that in 5 years, the yield to maturity on a 15-year bond with similar risk will be 8.5%. How much should you be willing to pay for bond X today? (Hint: You will need to know how much the bond will be worth at the end of 5 years.)

Bond X is noncallable and has 20 years to maturity, a 9% annual coupon, and a $1000 par value. Your required return on bond X is 10% and if you buy it you plan to hold it for 5 years. You (and the market) have expectations that in 5 years, the yield to maturity on a 15-year bond with similar risk will be 8.5%. How much should you be willing to pay for bond X today? (Hint: You will need to know how much the bond will be worth at the end of 5 years.)

0

Comments

-

Sorry bro, you lost me at Bond X........0

-

Do you even 9% annual coupon, bro?"Give me a place to stand and I will move the earth."0

-

You understood my signature. Milas ellinika?Rain:Do you even 9% annual coupon, bro?"Give me a place to stand and I will move the earth."0 -

The answer is "B.""When I have found intense pain relieved, a weary brain soothed, and calm, refreshing sleep obtained by a cigar, I have felt grateful to God, and have blessed His name." - Charles Haddon Spurgeon0

-

Can't take credit. I googled it. Which led me to a funny quote.I chose that phrase for a few reasons. The first is that using Greek is always a means of vainly sounding more intelligent than you actually areThanatos0320:

You understood my signature. Milas ellinika?Rain:Do you even 9% annual coupon, bro?"Give me a place to stand and I will move the earth."0 -

Dub0

-

Is that so?Rain:

using Greek is always a means of vainly sounding more intelligent than you actually areThanatos0320:

You understood my signature. Milas ellinika?Rain:Do you even 9% annual coupon, bro?"Give me a place to stand and I will move the earth."0 -

No, just something funny I read.0

-

Seriously, though... you might find THIS LINK helpful in answering your question.Thanatos0320:I know a few of you do accounting and finance work. I'm hoping you'll be able to help me with a question I came across while studying. My mind has gone completely blank. I messaged my professor 2 days ago and he still hasn't replied.

Bond X is noncallable and has 20 years to maturity, a 9% annual coupon, and a $1000 par value. Your required return on bond X is 10% and if you buy it you plan to hold it for 5 years. You (and the market) have expectations that in 5 years, the yield to maturity on a 15-year bond with similar risk will be 8.5%. How much should you be willing to pay for bond X today? (Hint: You will need to know how much the bond will be worth at the end of 5 years.)"When I have found intense pain relieved, a weary brain soothed, and calm, refreshing sleep obtained by a cigar, I have felt grateful to God, and have blessed His name." - Charles Haddon Spurgeon0 -

Thanks I'll have a look at itPuff_Dougie:

Seriously, though... you might find THIS LINK helpful in answering your question.Thanatos0320:I know a few of you do accounting and finance work. I'm hoping you'll be able to help me with a question I came across while studying. My mind has gone completely blank. I messaged my professor 2 days ago and he still hasn't replied.

Bond X is noncallable and has 20 years to maturity, a 9% annual coupon, and a $1000 par value. Your required return on bond X is 10% and if you buy it you plan to hold it for 5 years. You (and the market) have expectations that in 5 years, the yield to maturity on a 15-year bond with similar risk will be 8.5%. How much should you be willing to pay for bond X today? (Hint: You will need to know how much the bond will be worth at the end of 5 years.)0 -

I dont really remember the specifics of doing this stuff... but here's what I notice. The coupon is 9% which is lower than your required return so you wl buy at a discount. Also sice you are sellin in 5 yrs, thats when the 8.5% ytm comes in. That determines the resale value 5years out. I bet you break it up into 2 parts, and find what pv a 10% return gives you, including the resale 5 yrs laterThanatos0320:I know a few of you do accounting and finance work. I'm hoping you'll be able to help me with a question I came across while studying. My mind has gone completely blank. I messaged my professor 2 days ago and he still hasn't replied.

Bond X is noncallable and has 20 years to maturity, a 9% annual coupon, and a $1000 par value. Your required return on bond X is 10% and if you buy it you plan to hold it for 5 years. You (and the market) have expectations that in 5 years, the yield to maturity on a 15-year bond with similar risk will be 8.5%. How much should you be willing to pay for bond X today? (Hint: You will need to know how much the bond will be worth at the end of 5 years.)LLA - Lancero Lovers of America0 -

And still, nobody has posted the inevitable...

It's all Greek to me, dude! :^)"When I have found intense pain relieved, a weary brain soothed, and calm, refreshing sleep obtained by a cigar, I have felt grateful to God, and have blessed His name." - Charles Haddon Spurgeon0 -

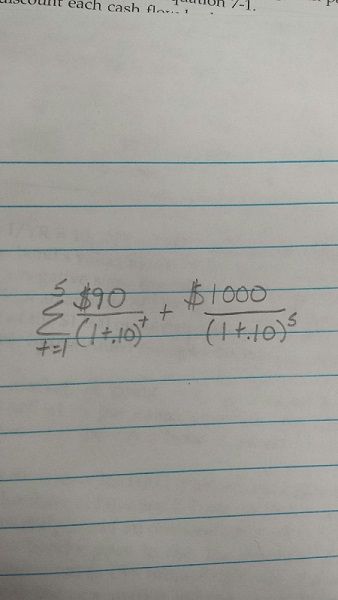

I figured out the answer for the price of the bond. I should really teach the class because my professor never helped me =. The price that you should buy the bond for is $962.09.

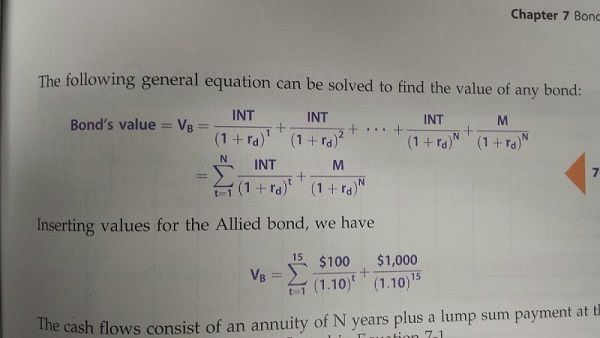

Rd=the market rate of interest on the bond. It's the discount rate use to calculate the present value of cash flows, which is also the bond's price.

N=the number of years before the bond matures. N declines over time after the bond has been issued; So a bond that had a maturity of 20 years when it was issued will have N=19 after 1 year, N=18 after 2 years and so forth.

INT=dollars of interest paid each year=coupon rate x par value. 1000 x .09=$90. If the payment had been semi annual then the payment would have been $45 every month.

M=the par, or maturity, value of the bond=1000. This amount must be paid at maturity.

I didn't completely follow the formula. Because i'm going to sell the bond in 5 years I made N=5 rather than 20 and instead of using the interest rate of 8.5% i used 10% because that's the required return I need. So with the 10% it'll show the most I'll have to pay. Anymore than 10% then the price of the bond will decrease. If you have a finance calculator then you can make N=5, I/Y=10, PMT=90, FV=100, and solve for PV. Here is my work. 0

0 -

Nice job! I had to study this stuff for my Series 6 exam, but it's not something I work with on a regular basis. Kudos to you for working through it and finding the answer!"When I have found intense pain relieved, a weary brain soothed, and calm, refreshing sleep obtained by a cigar, I have felt grateful to God, and have blessed His name." - Charles Haddon Spurgeon0

-

Try the series 7 and 66. If you understand bonds and calculations the 7 will not be so bad. Allows a much broader spectrum of products to sell from, if you can sell them anyhow. If your only focus is mutual funds then 6-63. Did a lot of work with variable joint life policies.0

-

....and this is why I became a Historian and Tobacconist.... Just looking at these equations gives me anxiety lol.0

-

Ive thought about taking my series 7. This December I'm taking the first part of the CFA exam. That's a test I'm worried about because last year only 30% of the people who took the test passed.Marker:Try the series 7 and 66. If you understand bonds and calculations the 7 will not be so bad. Allows a much broader spectrum of products to sell from, if you can sell them anyhow. If your only focus is mutual funds then 6-63. Did a lot of work with variable joint life policies.0 -

The 7 is a lot harder than the 6. Mainly because the varied range of products beyond mutual funds you need to know. Puts, calls, options, bonds, valuation. Buy the training disk and run through dozens of practice tests. You will fail that test unless you practice how the questions are worded.Thanatos0320:

Ive thought about taking my series 7. This December I'm taking the first part of the CFA exam. That's a test I'm worried about because last year only 30% of the people who took the test passed.Marker:Try the series 7 and 66. If you understand bonds and calculations the 7 will not be so bad. Allows a much broader spectrum of products to sell from, if you can sell them anyhow. If your only focus is mutual funds then 6-63. Did a lot of work with variable joint life policies.0 -

Yea my gf's stepdad is a stockbroker and said the series 7 was really hard. Thanks for the adviceMarker:

The 7 is a lot harder than the 6. Mainly because the varied range of products beyond mutual funds you need to know. Puts, calls, options, bonds, valuation. Buy the training disk and run through dozens of practice tests. You will fail that test unless you practice how the questions are worded.Thanatos0320:

Ive thought about taking my series 7. This December I'm taking the first part of the CFA exam. That's a test I'm worried about because last year only 30% of the people who took the test passed.Marker:Try the series 7 and 66. If you understand bonds and calculations the 7 will not be so bad. Allows a much broader spectrum of products to sell from, if you can sell them anyhow. If your only focus is mutual funds then 6-63. Did a lot of work with variable joint life policies.0 -

Thanatos0320:

Ive thought about taking my series 7. This December I'm taking the first part of the CFA exam. That's a test I'm worried about because last year only 30% of the people who took the test passed.Marker:Try the series 7 and 66. If you understand bonds and calculations the 7 will not be so bad. Allows a much broader spectrum of products to sell from, if you can sell them anyhow. If your only focus is mutual funds then 6-63. Did a lot of work with variable joint life policies.

The Series 7 test is a CAKEWALK compared to the CFA test. Trust me, I've been in the industry for 20 years and the highest I ever got was the Series 6 and 65. CFAs are like Ph.D.s in comparison. Never took the 7 precisely because of the math. Never been a broker or advisor, just took them to increase my knowledge of investment marketing.

Bonds always confused the hell out of me and still do. That's why I buy only stocks. You always know where you stand with a stock--buy high, sell low, if you're the average investor. If you stock pays dividends it's pretty easy to calculate your yield. Bonds, on the other hand, can drive you nuts. If I ever wanted to buy a bond I'd just find the one offering the highest coupon rate selling below par (face value) and hold it to maturity.0 -

Wow well then I'm glad I'm studying about 8 months in advance. On top of that I've agreed to teach 2 other people to help prepare them for the CFA exam. It'll only make me study harder and understand the stuff better. I don't know what I'd do if I failed the test after paying $1240 just to take it.raisindot:Thanatos0320:

Ive thought about taking my series 7. This December I'm taking the first part of the CFA exam. That's a test I'm worried about because last year only 30% of the people who took the test passed.Marker:Try the series 7 and 66. If you understand bonds and calculations the 7 will not be so bad. Allows a much broader spectrum of products to sell from, if you can sell them anyhow. If your only focus is mutual funds then 6-63. Did a lot of work with variable joint life policies.

The Series 7 test is a CAKEWALK compared to the CFA test. Trust me, I've been in the industry for 20 years and the highest I ever got was the Series 6 and 65. CFAs are like Ph.D.s in comparison. Never took the 7 precisely because of the math. Never been a broker or advisor, just took them to increase my knowledge of investment marketing.

Bonds always confused the hell out of me and still do. That's why I buy only stocks. You always know where you stand with a stock--buy high, sell low, if you're the average investor. If you stock pays dividends it's pretty easy to calculate your yield. Bonds, on the other hand, can drive you nuts. If I ever wanted to buy a bond I'd just find the one offering the highest coupon rate selling below par (face value) and hold it to maturity.0 -

Thanatos0320:Wow well then I'm glad I'm studying about 8 months in advance. On top of that I've agreed to teach 2 other people to help prepare them for the CFA exam. It'll only make me study harder and understand the stuff better. I don't know what I'd do if I failed the test after paying $1240 just to take it.

The CFA designation is a great thing to have, because the material is so deep and technical that if you pass it you can pass just about any other NASD test. And CFAs have many more opportunities open to them other than being brokers or advisers. Many of them become fund analysts, stock analysts, and nearly every fund manager is a CFA these days. Having it is kind of proof that you can "talk the investment walk."0 -

My friend and I are taking the exam together. I don't have my books yet, but he just got his books in the mail. Looking at those books are really discouraging.raisindot:Thanatos0320:Wow well then I'm glad I'm studying about 8 months in advance. On top of that I've agreed to teach 2 other people to help prepare them for the CFA exam. It'll only make me study harder and understand the stuff better. I don't know what I'd do if I failed the test after paying $1240 just to take it.

The CFA designation is a great thing to have, because the material is so deep and technical that if you pass it you can pass just about any other NASD test. And CFAs have many more opportunities open to them other than being brokers or advisers. Many of them become fund analysts, stock analysts, and nearly every fund manager is a CFA these days. Having it is kind of proof that you can "talk the investment walk."0 -

Thanatos0320:My friend and I are taking the exam together. I don't have my books yet, but he just got his books in the mail. Looking at those books are really discouraging.

My advice: Take as much time as you need to study and learn. I've known people who were in the industry for many years and some took more than a year or more to study for CFA 1. Most people need 2-3 years to pass the two parts.0